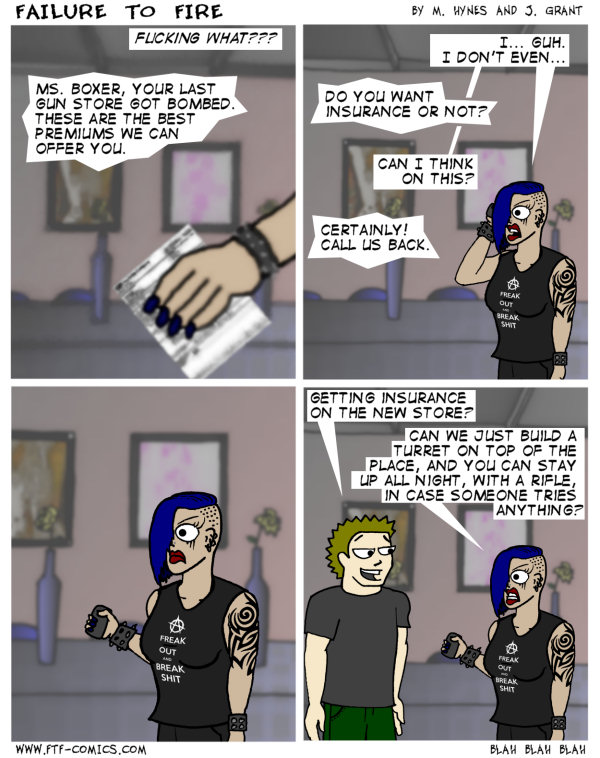

Precautions

Sep18

This isn’t entirely fiction. A friend’s father owned a t-shirt shop, and it caught fire. When he went to rebuild, his premiums had gone WAY up.

Some of you asked why they aren’t just rebuilding the shop. I’d point out that out here in Dallas, it’s often more cost effective to rent out or buy one of the many vacant warehouses in town, than to rebuild a burnt-down shop.

The new Celldweller album is out, and it is shit fucking hot. Seriously. I like this EASILY as much as Wish Upon a Blackstar, which was my favorite album before. If you like electronic metal industrial weirdness, you cannot go wrong buying this album.

God I am doing just horrible on keeping up with artist I like. I didn’t even know Celldweller came out with a new CD. I know what I’m picking up next paycheck.

The gunstore/range I work at burned down and we rebuilt but Its in a good location. took a year but it is 100 times better than it was

Besides, shopping for commercial real estate is fun! Grumble grumble

Careful your sarcasm is showing.

Turret, 24 hour security… I’m sure there’s quite a few people who’d volunteer for that shift.

Insurance companies suck, pay for decades and never have a claim yet each year your rates go up, if you suddenly do have a claim they double your rates and/or cancel the policy post haste…

They wouldn’t be so bad if the new American dream weren’t punitive damages and/or policy-limit awards for pain and suffering. Want insurance companies to be more reasonable? Support tort reform.

Obamacare doesn’t help either. (Or giving illegal aliens access to file suit in American civil courts.)

It’s a shame they don’t know a mall cop they could hire for overnight on-site security. Preferably a real bastard that doesn’t need to be in public during daylight hours…Wait…

Mick wouldn’t ever allow Alex to write Tom’s paycheck!

>I’d point out that out here in Dallas, it’s often more cost effective to rent out or buy one of the many vacant warehouses in town, than to rebuild a burnt-down shop.

Would you be able to get away with that? I know here in North Carolina as well as other states I’ve lived in, there are “eye sore” laws for properties that aren’t maintained. The town or city gets a judge to sign off on declaring a property to be an “eye sore”, the city moves in and fixes whatever is needed or even tears it down and the owner gets the bill along with some hefty fines for not doing so in the first place. That’s how they go after crack houses as well as the elderly and the poor who won’t sell their properties to developers.

Wow. It would be one thing for a commerical property, but to evict someone from their own home because they can’t afford new paint…

In Detroit, the building owner gets fined, then the owner gets a building permit. Then… does nothing for seven years as the building decays. The cost of tearing the building down is an excuse. Since some of the buildings occupy the only spaces where a bridge could be built, and the owner owns the only bridge into Canada, (and the gas stations near the bridge) the buildings are never coming down.

Thanks to Manuel Moroun, Detroit looks awesome in post apocalyptic movies.

That’s *exactly* what eminent domain is for.

Oh, wait. These days, eminent domain is for forcing widows to sell their house for a pittance so that Walmart can build a hugely profitable store. Never mind.

There’s more then Matty Moron making Detroit look like a toxic waste land. I’m at work right now, at Lyndon and Wyoming. No whee near the bridge. And it looks like a third world country.

And what really sucks about the whole bridge thing is we had a private citizen with a past record of successfully running and maintaining a bridge that wanted to build one and pay for it all himself, but the state decided it wanted to do it instead, so it boned him.

Definitely going to check out Celldweller a bit more. Thanks for introducing us.

Insurance is fraud, down with insurance companies.

To the comic: ring a different insurance company, put the store under Micks name, = no rate hikes >:).

I’m not sure I’d really call it fraud. However, here’s the trick about insurance that people miss: worthwhile insurance is generally not there to benefit the person paying for it, and a lot of common insurance is not worthwhile. Let’s look at auto insurance, for example. Full coverage auto insurance generally means PLPD, collision, and comprehensive. PLPD is worthwhile, but the other two are often not. Here’s how:

PLPD (Personal Liability and Property Damage) is not there to benefit you. It’s there to benefit whomever or whatever you might hit. That’s why you’re legally required to have it. In fact, you can do the same thing with self-insurance; what matters is that you can prove you’re good for the money. When I worked for University of Michigan, I learned that they self-insure their university-owned cars rather than giving money to an insurance company; they aren’t going anywhere, and their $8bil endowment can afford to buy somebody a new mailbox when an employee accidentally hits it. (Don’t ask me how I know this.)

Collision and comprehensive claim to be there to benefit you. In fact, they’re mostly there to benefit the insurance company (and possibly your bank). Let’s say that you buy a car, and the next day, somebody or something totals it. The idea behind collision or comprehensive is to keep you (and the bank) from being just plain screwed if you owe tens of thousands of dollars but have no car to take you to work (making it hard to repay the loan). However… The insurance company has already looked at you, your car, your driving area, etc and figured out how likely you are to get into an accident and how much it will cost to fix. They’ve worked this out into a monthly average, added their overhead and some profit to it, and that’s what they charge you for your premium. In other words, THEY’RE CHARGING YOU MORE THAN THEY THINK THEY’LL HAVE TO PAY. Maybe long odds will happen and they’ll actually have to pay out (meaning you will benefit from the insurance you’ve paid for)… but the odds are for them and against you.

In other words, if you can afford to replace your current car (which implies that it’s paid off), stop carrying collision and comprehensive on it. You no longer need that protection against the unlikely, and on average, you’ll spend more on the insurance than you’ll get out of it. (This same reasoning is why extended warranties are rarely worth the money, by the way.)

Insurance companies have to compete for customers. If Alex doesn’t get quotes from several, she’s really no good at business. And they ought to be able to suggest any number of risk-reducing behaviors that can lower her premiums.

Which is the real service that insurance companies provide — to measure risks, and give you incentive to prioritize and avoid them. That is in fact a real service. And of course they’re going to charge more than the service costs. Find me a for-profit company that doesn’t do the same, and I’ll show you a failing company.